Can Europe’s real-estate sector emerge from the darkness?

A new survey from the Urban Land Institute and PwC shows that sustainability is set to be the biggest factor in real-estate transactions but uncertainty still clouds the future for the sector

As the days shorten in the northern hemisphere and all eyes turn to prospects for 2024, what are we to make of the news that Europe’s real-estate market is still shrouded in ‘huge uncertainty’ and is struggling to recover from record low levels of deal-making?

According to a new report from the Urban Land Institute and professional services giant PwC, leaders in the sector are still coming to terms with inflationary pressures and high interest rates.

‘Emerging Trends in Real Estate: Europe 2024’ sets out a perspective in which many senior players are ‘forsaking dynamic strategies for a wait-and-see assessment of debt, valuations, construction costs and distress risks’. The report is based on a survey of 1,089 industry leaders.

Underlying occupier strength

Clearly, the current clouds of economic and political turmoil in Europe are affecting investment. The big UK and German economies are singled out for special concern. The one silver lining in the report is in a general perception of the underlying strength of occupier demand.

This might explain why three-quarters of those real-estate professionals surveyed believe that current property valuations ‘do not accurately reflect’ all the challenges and opportunities in real-estate. In other words, there is a fog hanging over much of the sector.

The report argues, for example, that ‘big calls’ will need to be made on where the hybrid working model eventually lands. Currently, the broader position on hybrid remains unclear. The survey points to a future in which overall costs, location and talent attractiveness will be the three most important factors driving workplace strategies by occupiers.

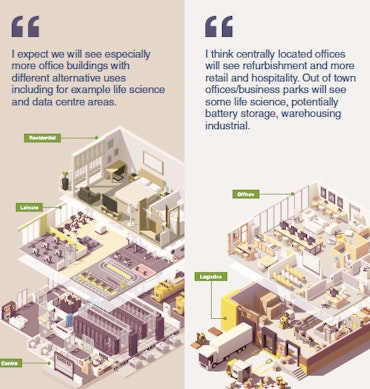

Shorter leases and more flexible workspaces are also likely to be part of the mix, alongside a progressive repurposing of real-estate assets to combines different uses in a single building or location. This strategy will see more ‘co-location’ of offices with retail and residential. Eight out of ten of those surveyed said this trend will increase in 2024.

A licence to play

However, the biggest factor at play in real estate is the environmental, social and governance (ESG) agenda. Compliance with ESG cuts across every sector, especially workplaces. As one CEO quoted in the report explains: ‘ESG compliance is not a “nice-to-have”. It’s a licence to play.’

Image: courtesy of the Urban Land Institute and PwC

Nine out of ten real-estate leaders believe ESG will have the biggest impact on real estate by 2050, although many in the sector are still figuring out how to measure the benefits of the ‘social’ aspect of ESG. Energy infrastructure emerges as the biggest influence on the sector, ‘offering the greatest overall prospects for investment, development and rents’.

‘London and Paris remain on top. Madrid, Milan and Lisbon all are on the rise…’

In terms of the key cities for investment, London and Paris remain on top. Madrid, Milan and Lisbon all are on the rise. But the German cities of Frankfurt, Berlin, Munich and Hamburg have slipped down the rankings in terms of development prospects, reflecting a gloomier outlook for the German economy which is criticised in the report for being slower to adjust its real estate pricing than elsewhere in Europe.

While the Urban Land Institute/PwC report presents a sobering assessment and does not pull its punches, there is something to cling onto in the office real-estate sector taking climate change more seriously and paying ever-closer attention to occupier needs around talent attraction and retention in a tighter market. There may be dark days right now, but shafts of light ahead.

Read the full Emerging Trends in Real Estate: Europe 2024’ report here.